Asbestos and Lead Removal Bill Clears Senate Environment and Energy Committee

On June 15, 2021, the Senate Environment and Energy Committee approved a bill to assist homeowners in removing lead and asbestos from their homes.

“For the health of residents, it is crucial to mitigate the risks of lead and asbestos in the home, but hazard abatement is costly,” said Sen. Christopher “Kip” Bateman (R-16) in a release. “This bill will make it easier for homeowners to do the right thing and have trained professionals remediate toxins and carcinogens from their property ensuring a healthy environment for current and future residents of the property.”

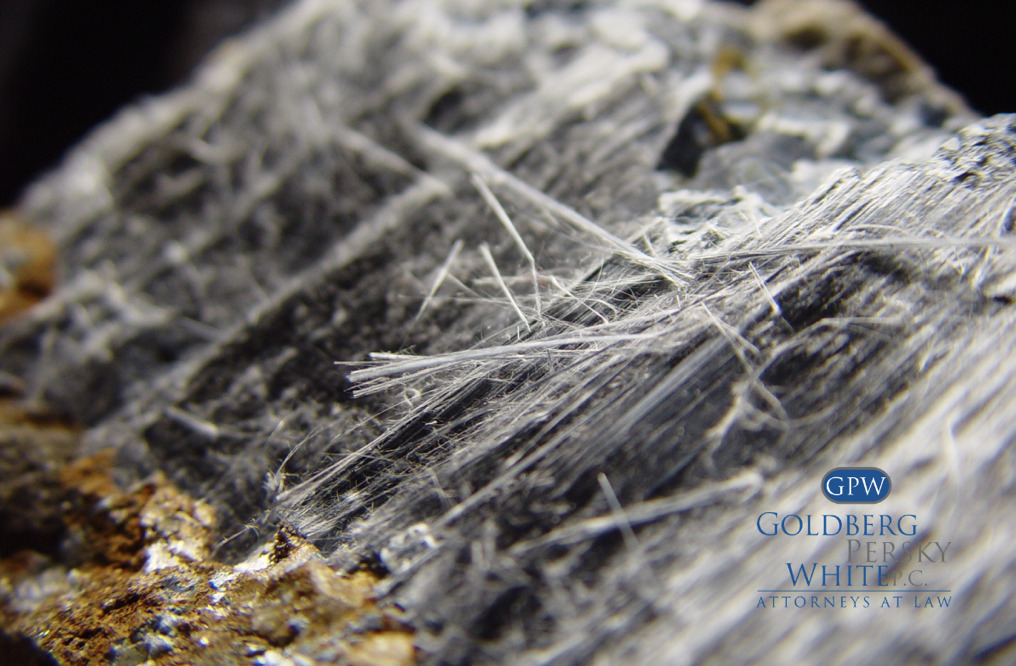

Despite federal limitations, asbestos is found in many older residences built before 1980. Asbestos is prohibited in construction materials and production techniques under federal law. These rules, however, do not apply to asbestos goods that have already been placed in dwellings. Asbestos exposure is still a concern for many homes and contractors.

New Jersey state legislators are drafting an asbestos removal measure in response to this health danger. If passed, the law would allow homeowners to deduct the cost of removing hazardous waste from their homes from their gross income tax. This bill makes it possible to get rid of lead paint, lead pipes, and asbestos-containing products.

Contact a Specialist for Removal

The asbestos removal bill in New Jersey encourages homeowners to contact specialists. These people have been trained to handle the substance properly and safely. This bill protects not only homeowners, but also contractors and construction workers who could otherwise be at risk.

Bateman’s bill (S-1411) would allow taxpayers to deduct up to $25,000 in lead paint and asbestos abatement charges, as well as the cost of replacing lead-contaminated water lines, from their gross income. To take advantage of this benefit, you must hire a state-licensed specialist to come to your home and remove the lead or asbestos. Taxpayers would submit invoices to confirm the work was done to claim the tax deduction once the bill is passed and signed into law.

“Exposure to asbestos has been linked to lung cancer and other serious conditions,” Bateman said. “This bill will help eradicate these silent threats from our communities.”

If you or a loved one is suffering from mesothelioma or lung cancer, you may be entitled to compensation. Contact Goldberg, Persky & White, P.C., for a free consultation to learn more.

Sources:

Duggan Julia, “Asbestos and lead removal bill clear Senate Environment and Energy Committee” My Central Jersey (June 2021) [Link]

Strand Tara, “New Jersey Bill Could Help Cover Asbestos Removal Costs” Mesothelioma.com (July 2021) [Link]